Use the right refinance program to save money monthly and thousands of dollars of back-end mortgage interest

Verify Your Hometown Heroes Refinance Eligibility

Did you get the Hometown Heroes grant to purchase your home? If so, you need to know the only way to refinance down to a lower market rate is to pay the grant off.

Below, we will explain how to pay the grant off without coming out of pocket and how to use the right refinance program to save you money monthly and thousands of dollars of back-end mortgage interest.

When you purchase your home and get a grant (like the Hometown Heroes Grant) or a second mortgage, and the grant or second mortgage is closed at the same time as the primary (1st) mortgage, you are eligible to pay off the grant or second mortgage using a rate and term refinance.

Florida Hometown Heroes Refinance Calculator - Are you a homeowner in Florida with a Hometown Heroes loan looking to refinance? Use the calculator now and get instant results on whether you qualify to refinance your Hometown Heroes loan into a lower interest rate without any out-of-pocket costs.

While it may not seem significant to the average consumer, there is a huge difference rate-wise when you compare a rate and term refinance and a cash-out refinance.

The reason is the loan level pricing adjustments when you select to do a cash-out refinance. DO NOT USE A CASH OUT REFINANCE to pay this grant off! The proper process to pay back the grant is using a RATE AND TERM REFINANCE.

A rate and term mortgage refinance is a type of mortgage refinancing in which a borrower replaces their existing mortgage with a new one, primarily to secure a lower interest rate or change the loan term.

The key objective is to improve the financial terms of the mortgage without increasing the loan amount significantly.

Here's a breakdown of the two components

This process involves obtaining a new mortgage with a lower interest rate than the existing one. By securing a lower interest rate, borrowers can reduce their monthly mortgage payments, save money over the life of the loan, or both.

In a term refinance, the borrower may also choose to change the term or duration of the loan. For example, someone with a 30-year mortgage might refinance into a 15-year mortgage or vice versa.

Shortening the loan term usually results in higher monthly payments. Still, it can save money on interest over the life of the loan, while lengthening the term can reduce monthly payments but may result in paying more interest over time.

Overall, homeowners often pursue a rate and term refinance to take advantage of lower interest rates or modify the structure of their loans to suit their financial goals better.

Considering the costs associated with refinancing and evaluating whether the potential benefits justify the expenses involved is important.

The short answer is equity. When you buy a home, you are investing in yourself. Ways equity is created:

Market appreciation. Most homes in Florida are appreciating at 8%+ per year.

Normal mortgage payment amortization.

Sweat equity. Any projects or upgrades done to your home = equity.

Using these three factors above, you have the equity to pay back the 5% grant based on your initial loan amount to pay the grant back WITHOUT having to write a check at closing to pay the grant back.

Your loan amount was 300k, which equals an initial grant of 15,000.00. The goal of the refinance will be to pay the 15,000.00 back to the state of Florida and cover the refinance fees of 3%.

The initial home value price was 315k. Assuming one year of 8% appreciation, the new home’s value is 340,200. Just through appreciation, you have 25,200.00 of home equity.

Through your first year of homeownership, let’s assume through mortgage amortization that you paid down the principal loan amount 5,000.00. That is an additional 5,000.00 of equity you can use to your advantage.

The X factor that is borrower specific (sweat equity): any number of upgrades like but not limited to roof, siding, kitchens, bathrooms, solar, flooring, and windows is money you spent but equity you gained.

A safe ratio to use for these repairs is a 1:1 ratio of cash spent compared to equity gained. Add this number into the equity calculation (I will leave out).

Total equity gained in year one of homeownership= 30,200.00

You take this 30,200.00, pay off the 15,000.00 grant, and cover all closing costs associated with the refinance.

This will allow you to stay at the target 95% loan-to-value ratio and show up to closing with 0.00 out-of-pocket. The higher the appraised value comes in, the lower your loan to value.

The specific loan documents required for a mortgage refinance can vary depending on the lender, the type of mortgage, and the borrower's financial situation.

However, here is a general list of common documents that are often requested during the mortgage refinance process:

When considering a rate and term mortgage refinance, it's important to be aware of the various costs involved.

While a refinance can potentially save you money over the long term, you'll need to factor in the upfront expenses associated with the process.

Here are some common costs associated with a rate and term mortgage refinance:

Closing costs include fees for various services, such as loan origination, appraisal, credit report, title search, title insurance, and attorney fees. These costs can vary significantly depending on the lender and location.

The lender charges this fee for processing the loan application. It's usually expressed as a percentage of the loan amount.

Lenders often require a new appraisal to determine the property's current value. The borrower is typically responsible for covering this cost.

Lenders may charge a fee to obtain your credit report as part of the underwriting process.

Fees associated with a title search to ensure no outstanding liens on the property and the cost of title insurance to protect the lender against potential title issues.

Charges for recording the new mortgage with the appropriate government office.

Interest that accrues on the new loan between the closing date and the end of the month.

If your property taxes and homeowners’ insurance are paid through an escrow account, you may need to prepay these expenses at closing.

Optional upfront fees paid to the lender to lower the interest rate. Each point typically costs 1% of the loan amount and can result in a lower interest rate.

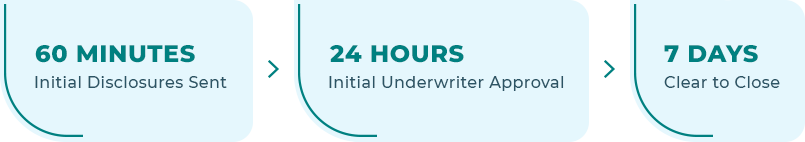

Discover unparalleled rates and loan choices tailored to your needs with us. Experience industry-leading speed at every step of the process.

Our commitment is to be your reliable advisor, delivering exceptionally personalized service to guide you seamlessly through the loan journey — from the initial application to closing.

We aim to surpass your expectations, ensure satisfaction, and earn your unwavering trust. Choose us for a lending experience that goes above and beyond.

Unlock competitive industry rates through the most competitive network of lenders.

Time is of the essence – achieve Application to Clear to Close in two weeks or less.

Benefit from our client-first process and proactive operations team, which is dedicated to delivering a best-in-class client experience. Your success is our priority.

Fortified Security Measures: At Next Wave Mortgage, LLC, we prioritize the safety of your information. Our mortgage process is equipped with state-of-the-art security features to ensure the utmost protection of sensitive data throughout the journey.